Recent Projects

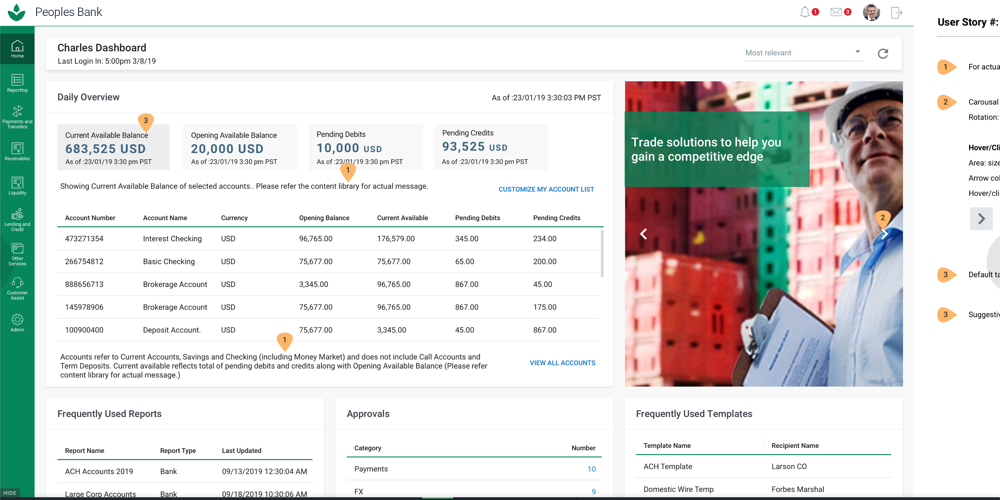

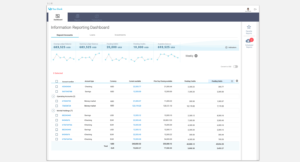

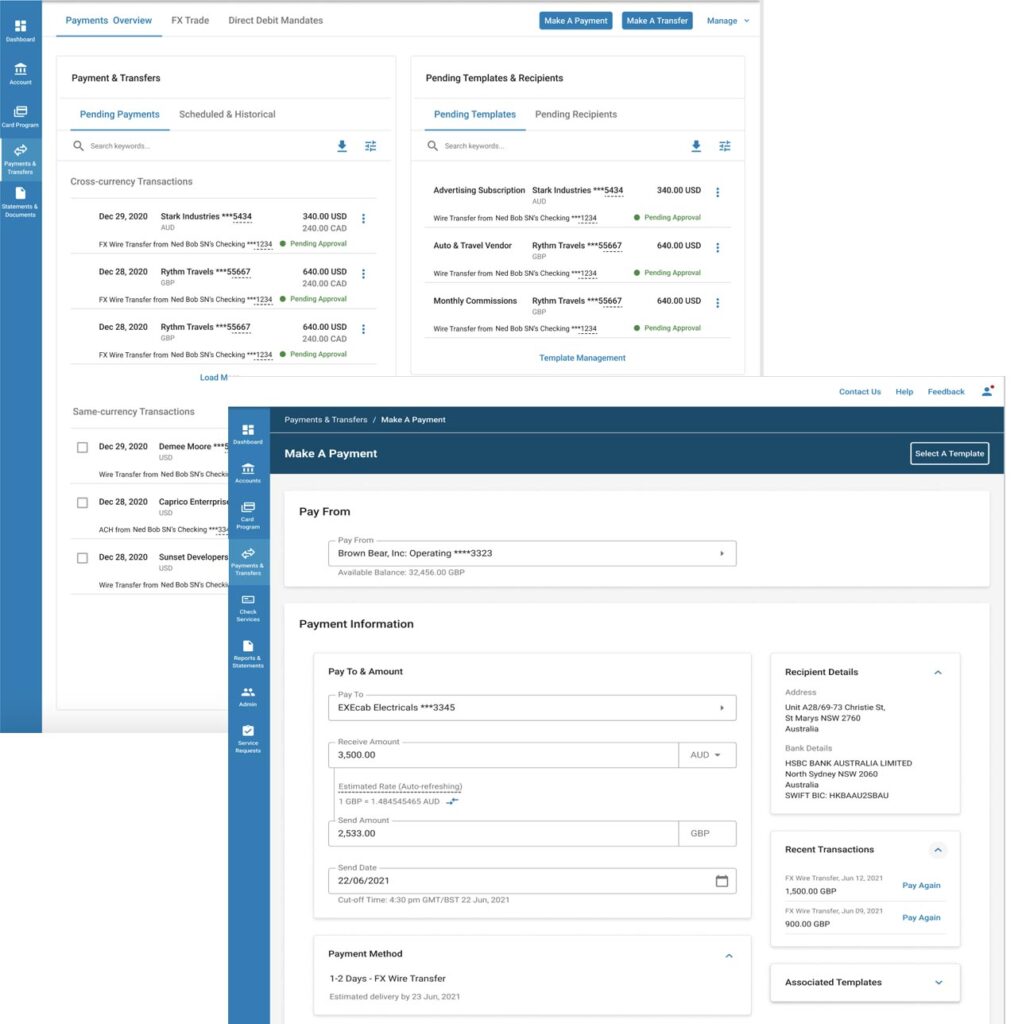

Corporate Banking

Business Banking Application for early stage and accelerated growth customer segments with special focus on Payments, Cards and Information Reporting.

Project highlights:

- Robust payment and tracking capabilities,

payment initiation and approval, customizable dashboards. - Global payments

Same currency and cross currency payments. - Information reporting

Detailed reporting on all payment activities from a single dashboard. - Accounting integrations

Integration with other popular accounting solutions - Card management

- Single interface credit and debit card program management and limit management.

Role: Consultant – Experience Design

Responsibilities:

- Analyze and review requirements

- Solution Definition – High Level and Detailed Design

- Support in Implementation, Deployment and Testing

- Support creation of to-be flows

- Support Global Component team for library updates.

- Identify enterprise social (collaboration) needs

- Map needs of users to Bank goals and perform task analysis

From 01/01/ 2021 to till date

Design Tools: Figma, MS Office, Sketch, inVision

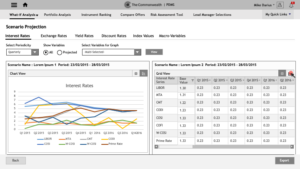

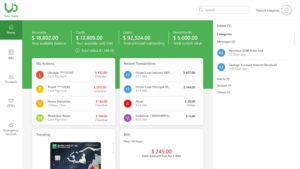

Treasury Management

Banking suite Implementation which include E-banking, Mobile Banking, Payment Hub, Alert Server and EVAuth.

Project Highlights

- Corporate e-Banking:

An omni channel enabled enterprise-class internet banking solution. This unified solution will help the bank to drive channel innovations, business growth and revenue, whilst delivering relevant, contextual and personalized customer experiences. - Corporate Mobile Banking:

Mobile Banking Solution will offer an intuitive and secure mobile banking experience to bank’s corporate customers. The solution has been designed based on the four tenets of agility, customer centricity, multi-modality and enterprise class compatibility. - Enterprise Payments Hub:

An advanced enterprise payments services hub that would help the bank to modernize its banking process. The solution would enable the bank to design and manage workflows, optimize processes and gain higher operational efficiencies. - Alert Server:

Alerts Solution would empower bank to provide multi-channel alerts to customers about transactions and events recorded by the bank’s diverse business systems. - EVAuth

EVAUTH solution offers a frictionless, intuitive, and secure banking experience to bank’s retail, corporate and SME customers. The solution delivers the seamless experience on a variety of mobile platforms, devices and access modes.

Role: Consultant – UX

Responsibilities:

- Analyze requirements and review specifications

- Solution Definition – High Level and Detailed Design

- Support in Implementation, Deployment and Testing

- Build and maintain a library of digital assets

- Support creation of to-be flows

- Identify enterprise social (collaboration) needs

- Perform heuristic evaluation of existing application/website/portal and competitor benchmarking and create a User Experience (UX) requirements inventory

- Map needs of users to Bank goals and perform task analysis

- Study feasibility of needs in terms of technology, content, design, localization, internationalization, accessibility, and governance

- Conduct usability testing and develop a continuous user feedback framework

From 09/16/ 2017 to 12/25/2020

Tools: MS Office, Sketch, inVision, Adobe CC

Other Major Projects

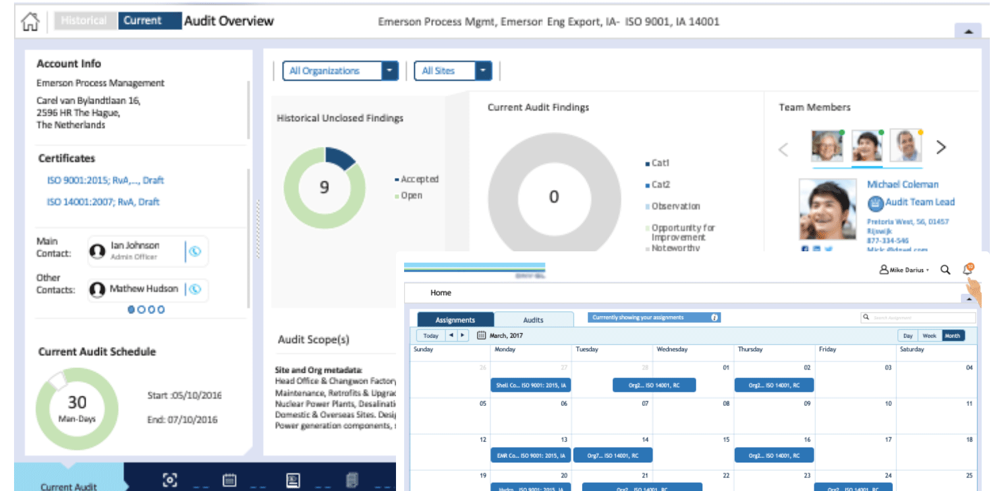

Business Assurance

Auditor app – an application supporting all core production activities carried by our auditors. Used by DNV GL employees and by the subcontractors. Auditor App generated a very high degree of adoption and thus significantly contributed to an important increase in production efficiency. The automation level and workflow capabilities enabled the auditors to focus on their core tasks and spend significantly less time and attention in the collateral and system-related area.

Project Highlights

- Audit planning, auditing and team collaboration (Offline and Online)

- Easy and system generated customer presentations

- Finding and management summary reports

- Audit completion and closure

Debt Management System

The main objectives of the DMS are to accurately record the debt that a member country has, produce reports of that debt both for internal and external use. Provide a controlled and disciplined environment for the receipt and payment of cash transactions resulting from that debt and assist, as much as possible, those managing debt to make the best possible decisions on the future borrowing and composition of debt portfolio.

Project Highlights

- Deal Management System

- Debt Analysis System

- Liability Management System

- Auditing

- Reporting System

- Master Data

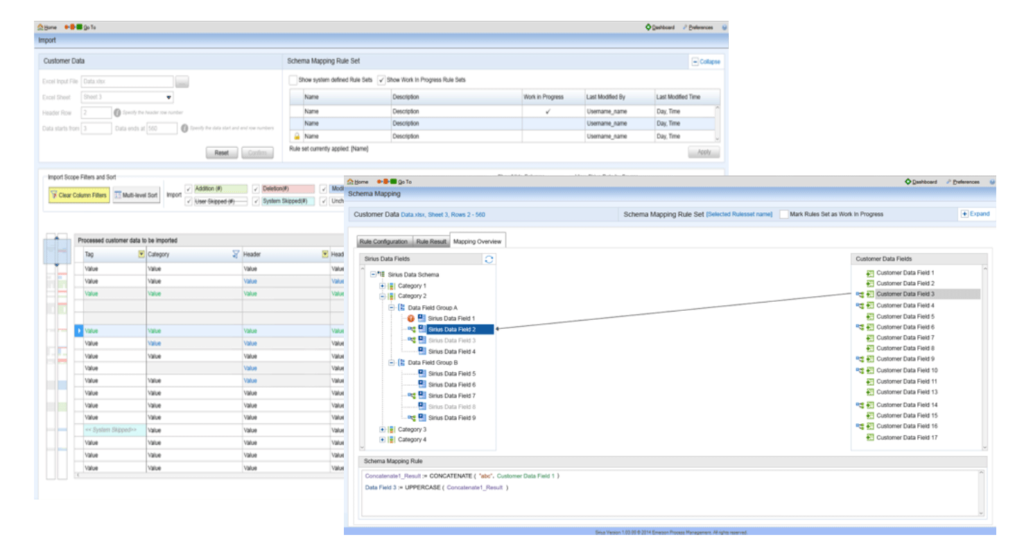

An Integrated Engineering Environment

An Integrated Engineering Environment that provides functionality to prepare the project library, import and process the customer data, and link the customer data to the library elements.

The primary objective of the system was to help an Engineering giant to save time and cost towards training, rework and maintenance across their engineering units.

Project Highlights

- Scope management and change control

- Data completion and verification

- Documentation

- Automatic code generation

- System health checks

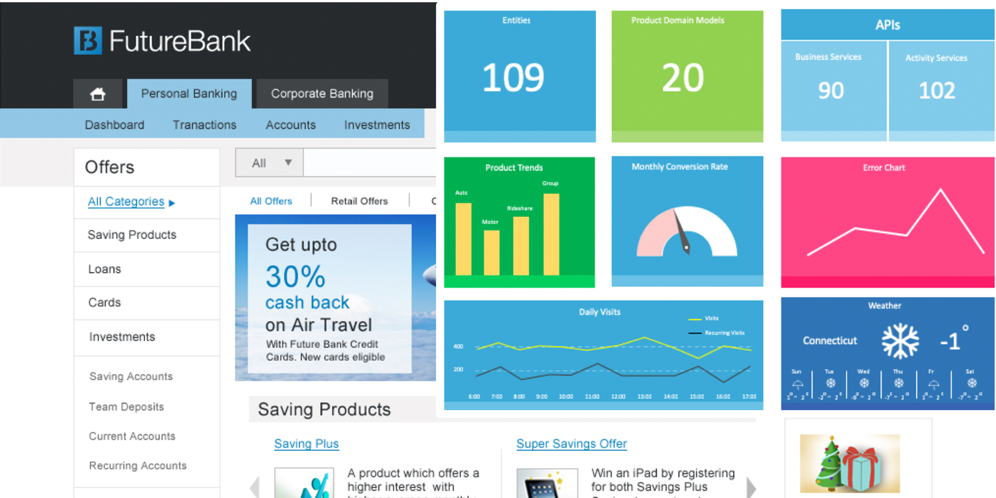

Universal Banking Solution

Finacle 11E is the latest release of the award winning Finacle universal banking solution. It is the industry’s most advanced universal banking solution that simplifies banking. The solution addresses core banking, e-banking, mobile banking, CRM, payments, origination, treasury, liquidity management, and wealth management requirements of retail, corporate and universal banks worldwide.

Project Highlights

Major Products delivered under Enterprise suite are:

- Offers and Catalog – An enterprise marketing micro site to create and publish offers across channels instantly

- CMS – A template based Contract Management System to reduce inconsistencies across departments and product lines and simplify customer contract generation process

- Dashboards – A single screen display of various operations of bank Users.

- Multi Channel Framework (MCF) – An enterprise class channel management solution that empowers banks to drive customer loyalty by providing seamless experience across channels.

- User Role Management (URM) – Solution to define and maintain roles and access controls of users from a single common place.

- Global Inbox- A common place for all alerts and notifications with reporting capabilities and multi-level referral structure.

Global Cap – Business Catalog

GlobalCap is a product catalogue widely used by bankers. Bankers can access product capabilities based on their current geographic location. Global Cap use latest technologies like GPS tracking and automatic alerts.

Project Highlights

- Online product catalogue which empowers bankers to deal with potential customers considering the legal framework associated with different geographical locations.

- The application enables bankers to access and manage various customer contracts.